This is an article written by Anthony Caravello and published by Coingecko, see the originally published article: https://www.coingecko.com/learn/what-is-mev-maximal-extractable-value-crypto

What Is Malicious MEV?

Malicious Maximal Extractable Value (MEV) is when bots exploit your pending transaction for profit, often using tactics like jumping ahead of your trade (front running) or trading around it (sandwich attacks), which end up giving you a worse price.

Not all MEV is bad. Some, like arbitrage or liquidations, can help keep markets efficient.

But for the sake of this article, we're going to focus on malicious MEV — the kind that hurts average crypto users.

Key Points:

- All users are at risk of malicious MEV, even those making small trades, across major chains like Ethereum, BNB Chain, Polygon, and Solana.

- These attacks are possible because most blockchains expose pending transactions in a public mempool, allowing bots to see and act on them before confirmation.

- You can protect yourself today using protected DEXs, private RPCs, or wallets with built-in MEV defense, each with tradeoffs in trust, coverage, and ease of use.

- In the future, protection will be automatic, as encrypted mempools roll out across chains and hide transactions by default without any user setup required.

Who’s At Risk of Malicious MEV?

In short, all crypto users.

Malicious MEV doesn’t just target whales — even those making small swaps can be profitable to bots. Whether you're swapping tokens, minting NFTs, or bridging assets, your transaction can be seen and exploited before it confirms.

These attacks happen across many popular chains, including Ethereum, BNB Chain, Polygon, and Solana.

Why Do These Attacks Happen?

The root cause is from the transparent nature of public blockchains.

For many chains, by default, every transaction passes through an unencrypted public mempool, which is a waiting area for all transactions until they’re confirmed. And everything in the public mempool is visible to all.

It’s here that bots see your transactions coming, then rearrange or even replace them for their own gain.

They profit while you lose — often just a few cents, but sometimes half your trade. In fact, Since 2020, more than $1.8 billion has been drained from Ethereum users only through MEV, much of it from malicious tactics like front running and sandwich attacks.

How to Protect Yourself Today

The good news is that there are several ways to help your transactions against malicious MEV, each with its own pros and cons. A simple starting point is to lower your slippage tolerance. From there, you can explore more robust tools built specifically to protect users.

Protected DEXs

Some decentralized exchanges (DEXs) are designed from the ground up to various forms of malicious MEV. Here are a few.

CoW Swap, 1inch, and UniswapX are three examples of DEXs that protect users from MEV by keeping trades off-chain and out of the public mempool. CoW Swap uses batch auctions where solvers compete to settle multiple trades at once, while 1inch and UniswapX let trusted parties bid to fill individual trades privately. In all three cases, your transaction stays hidden from bots, helping you avoid front running, sandwich attacks, and unnecessary gas fees.

Pros:

- Easy to use. No custom setup needed — just trade through the DEX.

Cons:

- You can only trade the supported tokens and on certain chains.

- Relies on third-party solvers to settle trades (abuse is still possible but rare — if the solver decides that attacking the transaction is more valuable than acting honestly).

- Does not protect against cross-DEX or cross-DeFi MEV, where bots extract value by coordinating trades across multiple protocols outside the protected system.

Private RPCs

Another option is to set up a private RPC in your wallet, which allows you to route your transaction to a private pathway to keep it hidden from the public mempool.

- Private mempools: MEV Blocker, Flashbots Protect are two of the most widely used. They forward your transaction to a small set of trusted builders in a “private mempool” who include it without exposing it publicly.

- Encrypted mempools: Instead of sending transactions to a “private mempool”, Shutter Network enables transactions to be sent to an “encrypted mempool”, which obscures transaction contents from everyone, including builders.

Pros:

- Once RPC is added, it provides you with protection across DEXs, DEX aggregators, and dApps.

Cons:

- Requires you to manually add a custom RPC in your wallet settings.

- Many Private RPCs process transactions in a “private mempool” which relies on trusting third-party builders to settle trades (abuse is still possible but rare — if the builder decides that attacking the transaction is more valuable than acting honestly). The exception to that are RPCs that process transactions in “encrypted mempools”, which obscures transaction contents from everyone.

- Chains supporting “public mempools” are limited to Gnosis Chain, but to expand soon to Ethereum.

Built-in Wallet Protection

Many popular wallets now offer some form of built-in protection against malicious MEV — either automatically or as an opt-in feature. This makes it easier for users to trade safely without setting up custom RPCs or using protected DEXs. A few of these wallets with built-in protection include MetaMask, Rabby, Ledger, and Trust Wallet.

Pros

- No setup required, protection is built-in.

- Easy to use, protection is often automatic or enabled by pushing a button.

Cons

- Not all wallets offer malicious MEV protection.

- Malicious MEV protection is often limited to a limited number of chains.

- Often relies on trusting third-party infrastructure (You must trust they’ll act honestly).

- Many third-parties process transactions in a “private mempool” which relies on trusting third-party builders to settle trades (abuse is still possible but rare — if the builder decides that attacking the transaction is more valuable than acting honestly).

- Some wallets don’t clearly explain how their protection works.

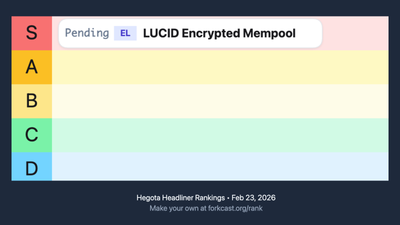

Tomorrow’s Defense: Built-in Protection With Encrypted Mempools

Right now, avoiding malicious MEV means choosing the right tools. In the future, you won’t have to choose at all - protection will be built in.

That is the long-term promise encrypted mempools make possible. They are the prerequisite for one day delivering protection by default at the protocol level.

Encrypted mempools hide transactions until ordering is finalized, removing the early visibility that front running, sandwich attacks, and real-time censorship rely on. Bots cannot attack what they cannot see. Over time, this creates a path toward users no longer needing to change settings, add RPCs, or switch wallets.

Unlike private mempools that route your transactions to a trusted set of builders who promise not to attack it, encrypted mempools keep your transaction hidden from everyone.

Encrypted mempools are also designed to support many types of encryption. This makes them future proof. New techniques such as threshold encryption or fully homomorphic encryption can be added over time without changing how users interact with the chain.

Chains across the ecosystem, including Ethereum, Optimism, BNB Chain, Arc, and Aptos, are now exploring encrypted mempools, moving toward a future where everyone gets malicious MEV protection by default, with no setup required.