The agentic future of finance isn’t coming—it’s already here. Platforms like Bankr, Nani, and others have made it easier than ever for crypto traders to execute transactions with just a simple command. No manual calculations, no navigating complex interfaces—just type and trade.

But here’s the problem: while autonomous broker agents make trading easy, they also expose your transactions to the world. The moment you submit a trade, the agent can see it, it’ll pop up in the public mempool (if their agent doesn’t use a private mempool) and sometimes even all of X-Twitter can see your trading intent. So essentially, it’s visible to everyone—including front-runners and MEV bots looking to exploit your order before it gets confirmed.

Many of these agents also require custody of your funds, meaning they—not you—control your assets. Even if your trade isn’t publicly broadcast, you still have to trust the broker agent not to front-run you or sell your order flow. Real-world brokers have been caught doing the same thing, which is why front-running is illegal in traditional finance. It’s also why the EU cracked down on Payment for Order Flow (PFOF). Yet in crypto, these risks are still widespread.

Shutter’s Unique Solution: Shutter Agent + Encrypted Mempool

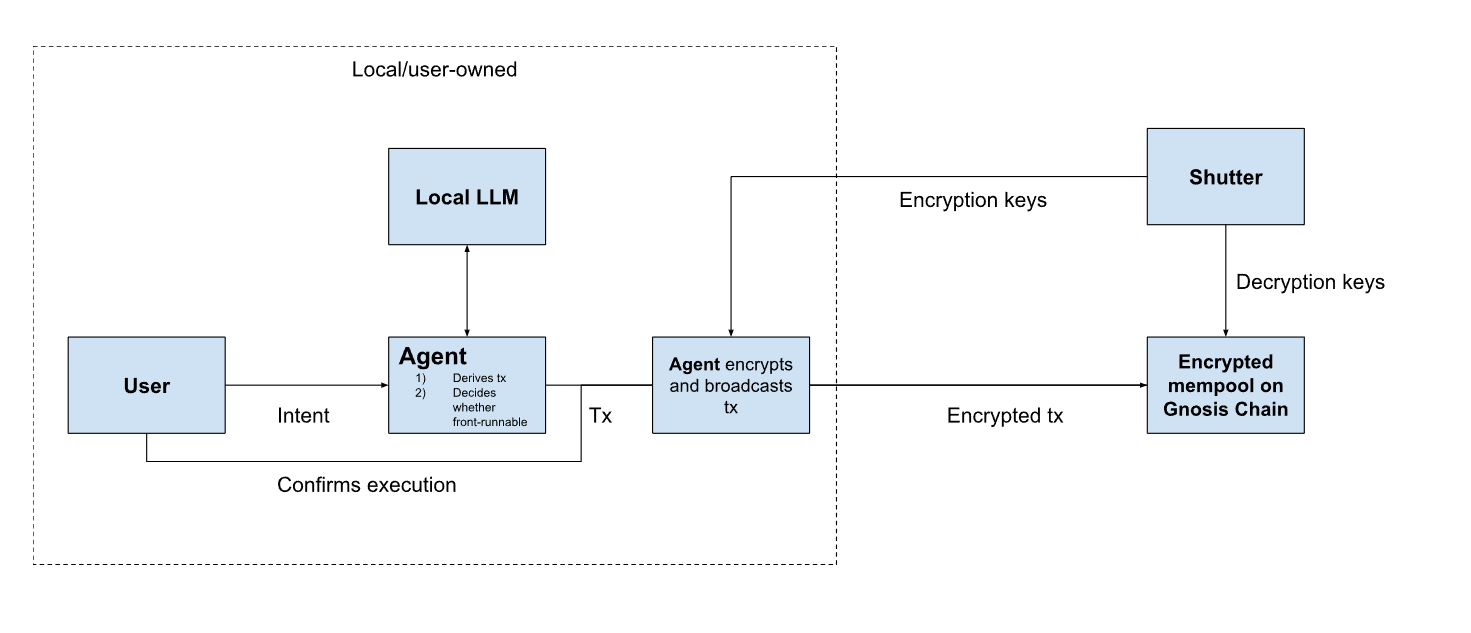

At Shutter, we believe agentic finance should work for the users—not against them. That’s why we built a little showcase with Shutter Agent, an experimental self-custodial trading agent powered by Shutter’s encrypted mempool on Gnosis Chain. You get the benefits of automation without sacrificing privacy or control.

Shutter Agent is designed to keep your trades private, your funds secure, and your transactions free from manipulation. Unlike other autonomous broker agents that expose your orders or take control of your assets, Shutter Agent ensures:

- Your trades remain private—Shutter’s encrypted mempool on the Gnosis Chain prevents your transactions from being visible before confirmation, removing front-running opportunities.

- Self-custody ensures that only you hold your funds, eliminating the need to trust a autonomous broker agent.

This means your trades stay hidden, your funds remain yours, and no one can exploit your transactions.

How Shutter Agent Works

- You give a command: Example: "Convert 10% of my stablecoins to UNI."

- Local Processing: Shutter Agent determines the best execution strategy while keeping all processing on your local device.

- Front-Running Protection: The agent detects MEV related risks and ensures your trade is protected before submitting it.

- Trade Confirmation: You review the transaction details before execution.

- Encrypted Execution: The transaction is encrypted and sent to Shutter’s encrypted mempool, ensuring privacy until finalized.

Shutter Agent vs. Broker Agents: Who’s Really on Your Side?

| Feature | Shutter Agent (Private Banker Agent) | External Broker Agent |

|---|---|---|

| Data Privacy | Nearly 100% secure when using a local language model. | Lower privacy; trade data may be exposed to the public or the agent/LLM operator. |

| Trade Privacy | High---transaction details are encrypted (thanks to Shutter). | Trade details are visible in the public mempool, risking front-running and censorship. |

| Control | Complete control remains with the user. | Control is limited (especially when the agent operates in wallet mode). |

| Incentives | Incentives are aligned with the user's interests, as the agent is owned by the user. | Brokers may have conflicting interests, such as profiting from order flow or even front-running trades. |

| Payment | Typically a one-time purchase or fees for specific services (e.g., a private TEE LLM service). | Usually a subscription fee model, often with additional revenue from selling order flow or engaging in front-running. |

What’s Next? This Can Be Built

Shutter Agent is currently an experimental concept, but it doesn’t have to stay that way. This technology can be built into a fully functioning system or integrated into existing agent platforms.

The next step is to develop and refine this model, adding new layers of security to make trading even safer:

- Trusted Execution Environments (TEEs): Secure hardware enclaves for running agent operations.

- Multi-Party Computation (MPC) Wallets: Enabling agents to operate under strict, pre-approved permissions.

- Fully Homomorphic Encryption (FHE): A future where agents process encrypted data without decryption.

On top of that, Shutter could help keep your agent’s private data safe. If your agent lives on-chain—as a smart contract—it could store and use sensitive information like encrypted instructions, credentials, or documents, without ever exposing them to the public.

Here’s how: with the Shutter API, that private data could be encrypted with an encryption key generated by a threshold of Shutter Keypers. No single key share reveals the whole thing. To access or use the data (like accessing a document on IPFS), a group of trusted parties (i.e., the Keypers) would need to work together. Even if one or multiple key shares gets leaked or attacked, the data stays protected.

The result? A smarter kind of agent—one that can act on your behalf, while keeping your data safe, protected, and only accessible when it should be. Autonomous, yes—but also private, secure, and built to handle risk.

The Choice Is Yours—Get Involved and Share

If you’d like to see Shutter Agent integrated into existing trading agents—or built as a standalone platform—reach out for a discussion and share this with others who might be interested.

Want to explore Shutter’s encrypted mempool in action? Check out: